Streamline Global Transactions for Your Financial Needs

Connect Businesses and Individuals to Success with Powerful International Money Transfer Solutions

Integrity

Collaboration

Innovation

Customer-Driven

Seamless Global Transfers for Every Purpose

Explore our specialized solutions designed for both personal flexibility and business growth

Business Account

Whether managing global payroll, or facilitating international payments, we provide the essential tools you need to succeed.

Personal Account

Whether sending financial support to loved ones, or paying for services abroad, it's the perfect choice for the global citizen.

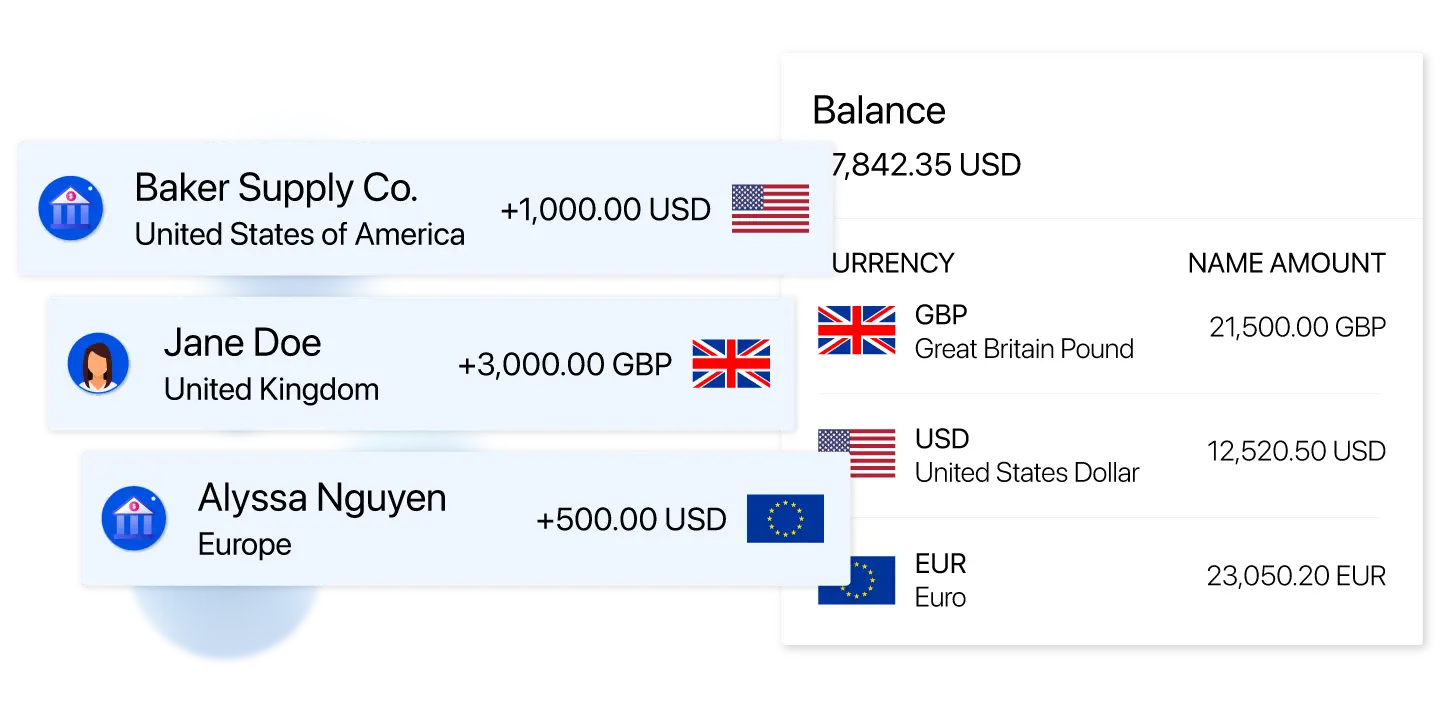

Your Financial Universe on One Platform

Handle global finances effortlessly—pay, manage currencies, and transfer funds for you and your business.

Business Account

Personal Account

Gain a Competitive Edge with DNBC

Break free from hidden fees, slow transfers, and poor support. Unlock

seamless transactions, bigger savings,

and rapid growth.

Your All-in-One Global Business Finance Hub

Say Goodbye to Bank Queues or Paperwork

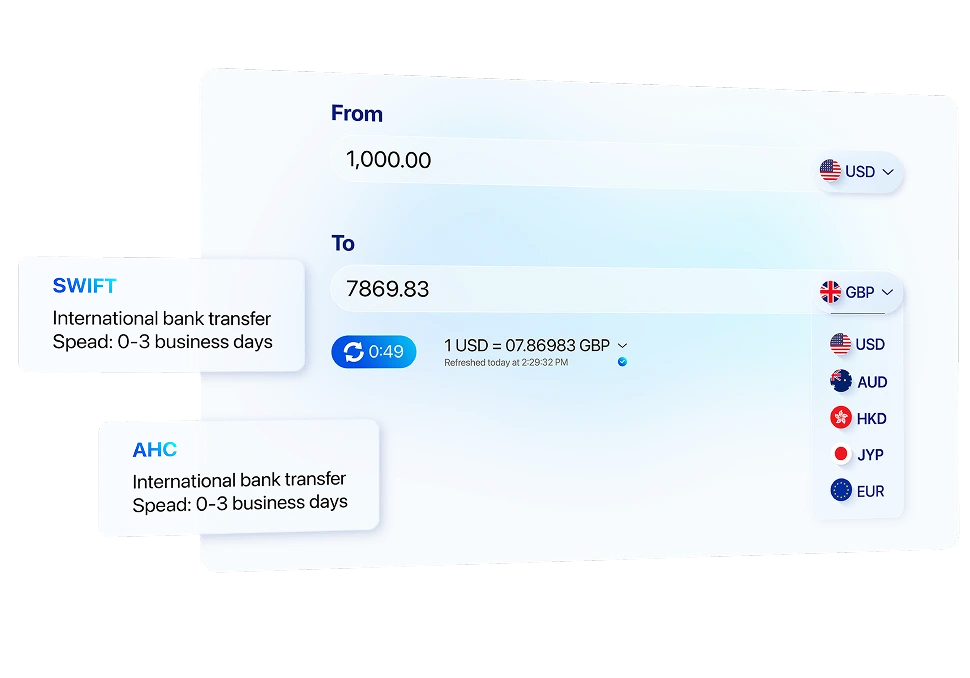

Operate Like a Local Business from Anywhere

Set up local accounts in minutes, accept payments in local currency to avoid conversion fees, manage multi-currency accounts in one platform, convert currencies at favorable rates, and make high-speed transfers around the world in a few clicks.

0+

Currencies Supported

0+

Countries To Make Domestic Transfers

0+

Countries To Make International Transfers

0+

Transfers Arrive Within The Same Day

Ready to Discover Your Ideal Financial Solution?

Schedule a consultation today to explore how we can help you achieve your financial goals.