UNLIMITED OFFERS: TAKE MORE, SAVE MORE

It’s time to enjoy unlimited offers with DNBC and unlock streamlined finances. Don’t miss this opportunity to elevate your financial experience with our tailored account options.

At DNBC Financial Canada, we simplify the complexities of payments, driving clarity and efficiency for our clients. Passionate about streamlining transactions, we're dedicated to ensuring your financial objectives are seamlessly met.

Simple, Convenient Transfers: Making Global Transactions a Breeze

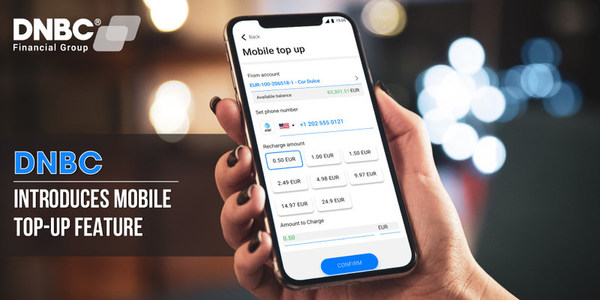

User-friendly: Navigate with ease. Execute transactions in a few taps.

Secure: Rely on state-of-the-art encrytion technology to protect your information.

Customizable: Tailored alerts, set favorite recipients and more.

Note: DNBCnet app caters to multiple jurisdictions, hence experiences may vary. Account policies, applicable laws, and features vary based on your profile location and the DNBC Group member servicing your account.

Embrace the future with DNBCnet: Your World. Your Terms.

Got questions about our services? Find answers below or contact us for further assistance.

It’s time to enjoy unlimited offers with DNBC and unlock streamlined finances. Don’t miss this opportunity to elevate your financial experience with our tailored account options.

Jan 14, 2023 04:20

Jan 14, 2023 04:19

Jan 14, 2023 04:17

Jan 14, 2023 04:10

Jan 14, 2023 04:57

Jan 14, 2023 04:56

Jan 14, 2023 04:55